As we approach the Reserve Bank of Australia’s (RBA) interest rate decision, the AUDUSD pair is trading near the critical level of 0.6600. The RBA is widely expected to hold the rate steady at 4.35%, a decision that could significantly influence the currency pair’s movement.

Current Market Context:

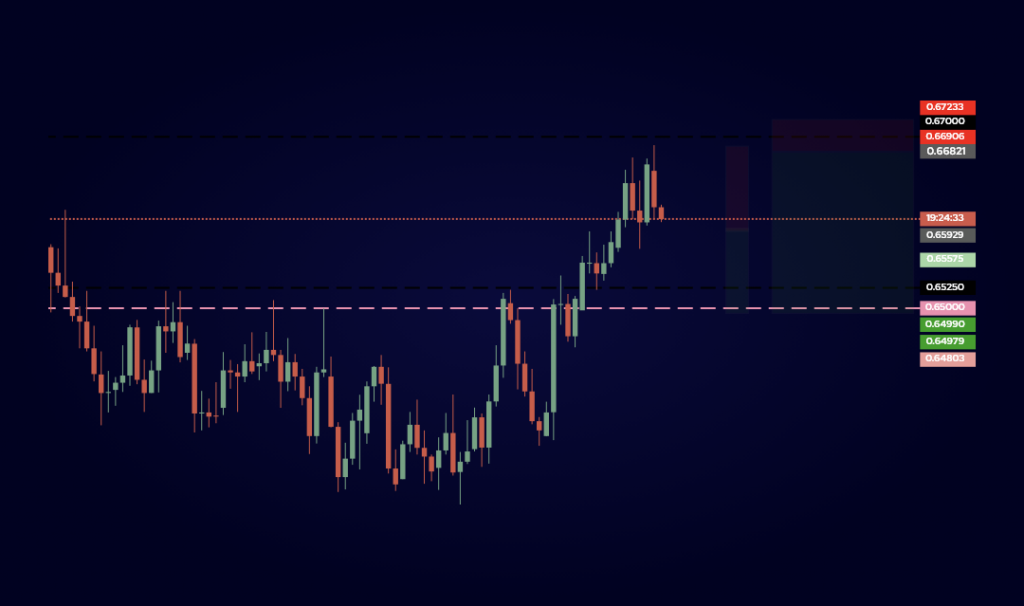

The AUDUSD’s position near 0.6600 comes amidst recent economic data showing a decline in the Consumer Price Index (CPI) from 5.6% to 4.9% last week. This drop in inflation could be a pivotal factor in the RBA’s decision-making process. The market anticipation of a steady rate could be already priced in, which sets the stage for potential currency fluctuations based on the RBA’s announcement and accompanying statements.

Trade Ideas for AUDUSD:

Scenario for Bearish Movement:

Trade Idea: If the RBA pauses the interest rate hike and references the recent CPI drop, the AUDUSD is likely to break below the 0.6600 mark. In this scenario, our preference leans towards shorting the pair upon a confirmed close below 0.6600.

Target Levels: The next support area is anticipated around 0.6500.

Entry Point: A confirmed close below 0.6600 would be an ideal entry point for a short position.

Scenario for Limited Bullish Reaction:

Trade Idea: Alternatively, the pair may react by pushing towards 0.6700. However, as long as AUDUSD remains below the 0.6700 threshold, our bias remains bearish.

Ideal Range for Shorting: The range between 0.6675 and 0.6725 presents a favourable opportunity to short the pair.

Target Levels: The targets for this trade would be set at 0.6600 and 0.6500.

Stop Loss: A stop loss should be placed at a minimum of 0.6725 to manage risk effectively.

Conclusion:

The upcoming RBA decision poses a significant event for the AUDUSD pair. Traders should closely monitor the pair’s reaction to the RBA’s statements and be prepared to capitalize on the outlined trade scenarios based on the market’s direction post-announcement.