Welcome to our detailed exploration of the Federal Reserve’s recent decisions and economic projections, offering key insights into the implications for investors and the broader economic landscape.

Steady on Rates:

The Federal Reserve has opted to maintain the federal funds rate at its current level of 5.25% to 5.5%. This decision reflects the Fed’s continuous efforts to balance economic stability with inflation control.

Forecast of Rate Cuts:

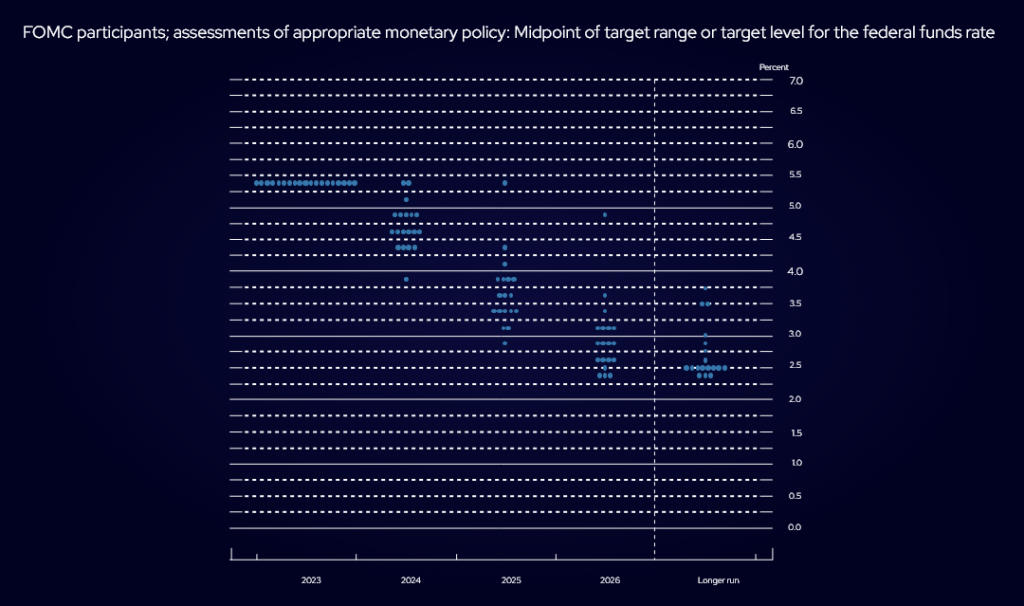

A significant development is the Fed’s projection of three rate cuts in 2024, followed by further reductions in 2025 and 2026. This ‘dot plot’ forecast suggests a shift towards easing monetary policy over the next few years.

Market vs. Fed Expectations:

The market, as indicated by the CME Group’s FedWatch tool, is pricing in more aggressive rate cuts of 150 basis points in the upcoming year, which would lower the funds rate to 3.75%-4%. However, the Fed’s projections are more conservative, not anticipating reaching these levels until 2025. This mismatch has led to a bullish market response, though it may not fully align with the Fed’s gradual approach.

Powell on Economic Conditions:

Fed Chair Jerome Powell has indicated a willingness to cut rates even in the absence of a recession, suggesting a focus on normalizing the economy. His comments reflect a nuanced approach to economic management, acknowledging progress in inflation control and a shift towards a more balanced labor market.

Labor Market and Wage Dynamics:

The labor market is entering a ‘sweet spot’, with job growth aligning more closely with sustainable levels given population growth and labor force participation. Wages, while still above the Fed’s 2% inflation target, are gradually cooling off.

Market Response and Policy Outlook:

The market’s optimistic reaction, with the Dow Jones surging past 37,000 points, can be attributed to the Fed’s signaling of future rate cuts and a formal lowering of its inflation forecast for 2024 to 2.4% from 2.6%.

Economic Growth and Inflation Update:

Despite a substantial slowdown in Q4 economic growth, the overall GDP is expected to expand around 2.5% for the year. The Fed’s efforts in controlling inflation are beginning to show results, but Chair Powell cautions that the path ahead is still uncertain.

Fed’s Preparedness for Further Action:

Chair Powell emphasized that while the Fed’s policy rate is likely near its peak, further tightening has not been ruled out. The Fed is committed to a monetary policy that is “sufficiently restrictive” to bring inflation down to its 2% target rate over time.

Economic Conditions and Recession Risks:

Powell acknowledged the resilience of the U.S. economy in 2023 but warned of the possibility of a recession in the future. Achieving a ‘soft landing’—bringing inflation back to 2% without causing a spike in unemployment—remains a challenging but essential goal.

In summary, the Federal Reserve’s recent announcements provide a multifaceted view of the current economic situation, balancing cautious optimism with a realistic appraisal of challenges ahead. The anticipated rate cuts, alongside positive trends in labor and inflation metrics, suggest a gradual move towards a more balanced economic scenario. We will continue to offer detailed analysis and strategic advice as the economic narrative unfolds.